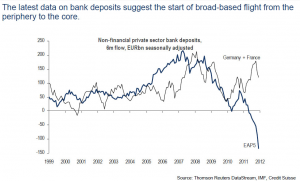

Bankrun in progress

This graph shows one of the very worrying problems banks in the peripheral countries have to cope with. People don’t trust their banks like they used to and take their money out in an ever increasing pace. That means that banks are running out of cheap funding in a hurry.

This graph shows one of the very worrying problems banks in the peripheral countries have to cope with. People don’t trust their banks like they used to and take their money out in an ever increasing pace. That means that banks are running out of cheap funding in a hurry.

Another problem is the fast deterioration of the bank’s balance sheets.

Bad loans

With Spain’s contracting economy and an unemployment’s rate of 23 percent, banks are increasingly easing terms for customers who are missing payments on mortgages. Pressure to renegotiate debt and delays in repossessions are raising doubts that default rates on Spain’s 613 billion euros of mortgages have stabilized.

The more they kick the can down the road however, the less visibility the markets have on what is really happening with asset quality.

Therefore investors view the 182 billion euros of bonds tied to Spanish residential-mortgage backed securities as being among the least creditworthy in Europe. The outlook for the collateral is expected to worsen as mortgage arrears rise with increasing unemployment and house prices continue to fall.

Forced writedowns

Spain’s government has taken steps to tackle the problem of souring real estate piled up on the balance sheets of banks by forcing them to recognize more losses. Lenders, which have about 175 billion euros of what the Bank of Spain terms “troubled” property assets, will have to take about 50 billion euros in provisioning costs or capital charges.

Will it be enough?

Analysts however are skeptical of data showing the improvement in mortgage arrears. “This is impossible, in our opinion, given the current economic environment and the evolution of unemployment,” said Santiago Lopez, an analyst at Exane BNP Paribas in a Feb. 15 report.

Banks in the meantime are easing mortgage terms for people hit by the financial crisis who can’t pay their loans. At least 400,000 mortgages have been renegotiated so far to avoid evictions.

It’s clear that banks go to great length to avoid that these properties end up on their balance sheet and they have to make more provision.

More writedowns to come

Still it seems very doubtful whether banks can keep mortgage arrears under control with a worsening economy.

The renegotiation’s, though, may contribute to investor concern that the bad-loan problem in Spain is still growing, even as the government takes steps to make banks recognize real- estate losses. While mortgage defaults represent a problem that will worsen for lenders, it’s not on a comparable scale with lending to property developers because the homes backing the loans have value.

The property boom that ended in 2008 left Spanish banks with 303.5 billion euros in loans related to real estate in the third quarter of 2011, according to the Bank of Spain. That’s after they were forced to take on properties and land in return for canceling debt held by bankrupt developers.

Bad mix

So banks experience increasing difficulty finding funding for their activities due to huge withdrawals by customers and reluctant investors, who are questioning the quality of the balance sheets.

So far the ECB through their LTRO’s ( long term refinancingoperations) has kept these banks alive with cheap money against basically any collateral. In doing so the ECB has prevented markets to correct themselves.

Banks still refuse to be proactive

Without this help banks would have been forced to deleverage their balance sheets by selling assets. That would have brought down real estate prices to more accessible levels and thus inviting third parties to invest.

Now they grow ever more dependent on outside help(ECB) until the moment they have run out of acceptable collateral.

Recognizing the inevitability of the fast approaching credit crunch, banks should take matters into their own hands and restructure their debts while there is still some reasonable market left.

Waiting too long will mean ever increasing fire sales and therefore ever diminishing survival possibilities.

The reason banks have not taken decisive action so far, could mean that their balance sheets are in far worse condition than they appear to be now.

That means that they have waited too long and overplayed their hand.

Google auteur

==================================================

Other posts you may like: