Just when financial markets calmed down a bit, the new boss of the International Monetary Fund, Christine Lagarde, came with an almost dramatic appeal to urgently recapitalize banks.

She even went as far to advise banks, which are unable to attract private capital, to apply for a government bail out.

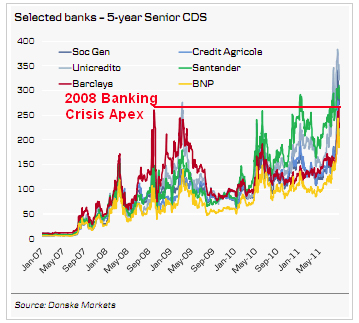

To show that this appeal doesn’t come completely out of the blue please check out the following chart:

insurance (CDS) for bonds issued by European banks

These insurance premiums against default of the 25 major European banks have doubled since April of this year according to Bloomberg. The same article also reports that even the ‘Euribor-OIS spread has widened the most since April 2009, a gauge of banks’ reluctance to lend to each other.

Banks are afraid again to lend to each other and solvent banks park their reserves back at the ECB.

These signals indicate that the funding market for banks is likely to freeze up again as it did in 2008/2009. That’s not good news at a time that these banks need to refinance € 80 billion this year plus the recapitalization requirements from the IMF.

Also note that it is not surprising that the IMF points to government’s bailouts if necessary, given the fact that another very important source of funding for the banks also threatens to dry up. In one month, the biggest American “money market funds” have withdrawn 9% of their funds from Europe! They apparently see what’s coming.

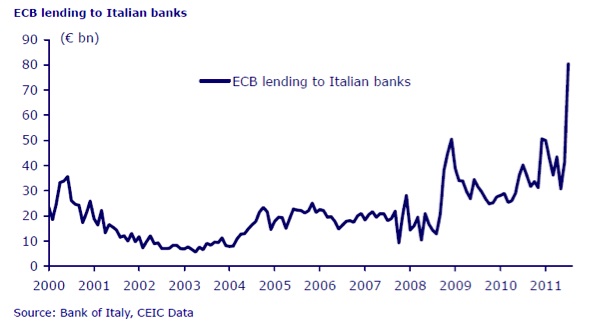

This means that especially the weaker banks will be again totally dependent on central banks for their survival . See for example this alarming graph:

ECB as a last resort for Italian banks

The balance sheet of the ECB must look miserable by now. Not only does it hold all these loans to the weak banks from various EU countries, but also the purchased bonds from those same countries. How many of these receivables will be paid ultimately is anyone’s guess.

Many of these problems are obviously related to the deleveraging of excess debts, that were built up in recent years. But an equally important structural part of the problem consists of the way the modern banks are funded nowadays.

Banks commit money, for example, through mortgage loans, for a long time, but fund it with cheap short-term loans, which they then have to constantly roll over.

For example, Morgan Stanley calculated that the 91 banks of the now already obsolete stresstest, have been funded for a total of € 8 trillion, of which 58% has to be refinanced within two years. The news that an unidentified bank abruptly needed € 500 million for one week and therefore appealed to the emergency fund of the ECB and the another news flash regarding the urgent need of a bank to fund only € 5 million, that apparently no one else was willing to lend them, are troublesome signs.

Against this background, it’s hard to understand the undignified spectacle the European politicians make of themselves. It is as if they don’t realize that they are dancing on top of a dormant volcano.

The will to help troubled countries of the EU erodes further and further. Finland purposely misinterprets the bailout deal made with Greece and demands cash as a guarantee and then plays the injured innocent. The Netherlands and Austria suddenly wake up and also call for more safeguards. The German Bundesbank called the bailouts unconstitutional, apparently anticipating a court ruling due early September.

Meanwhile, resistence is growing in the PIIGS countries against the austerity measures, budgets are disappointing again, the unemployment rate continues to increase which in turn causes more people to face payment problems. For example, 70,000 people in Dublin don’t pay their mortgage bills anymore. (> 20% of the population!).

Are the politicians simply failing to see the seriousness of the situation or have they already given up and hope that the ECB will solve everything for them? After the warning from the IMF the first alternative seems hard to believe.